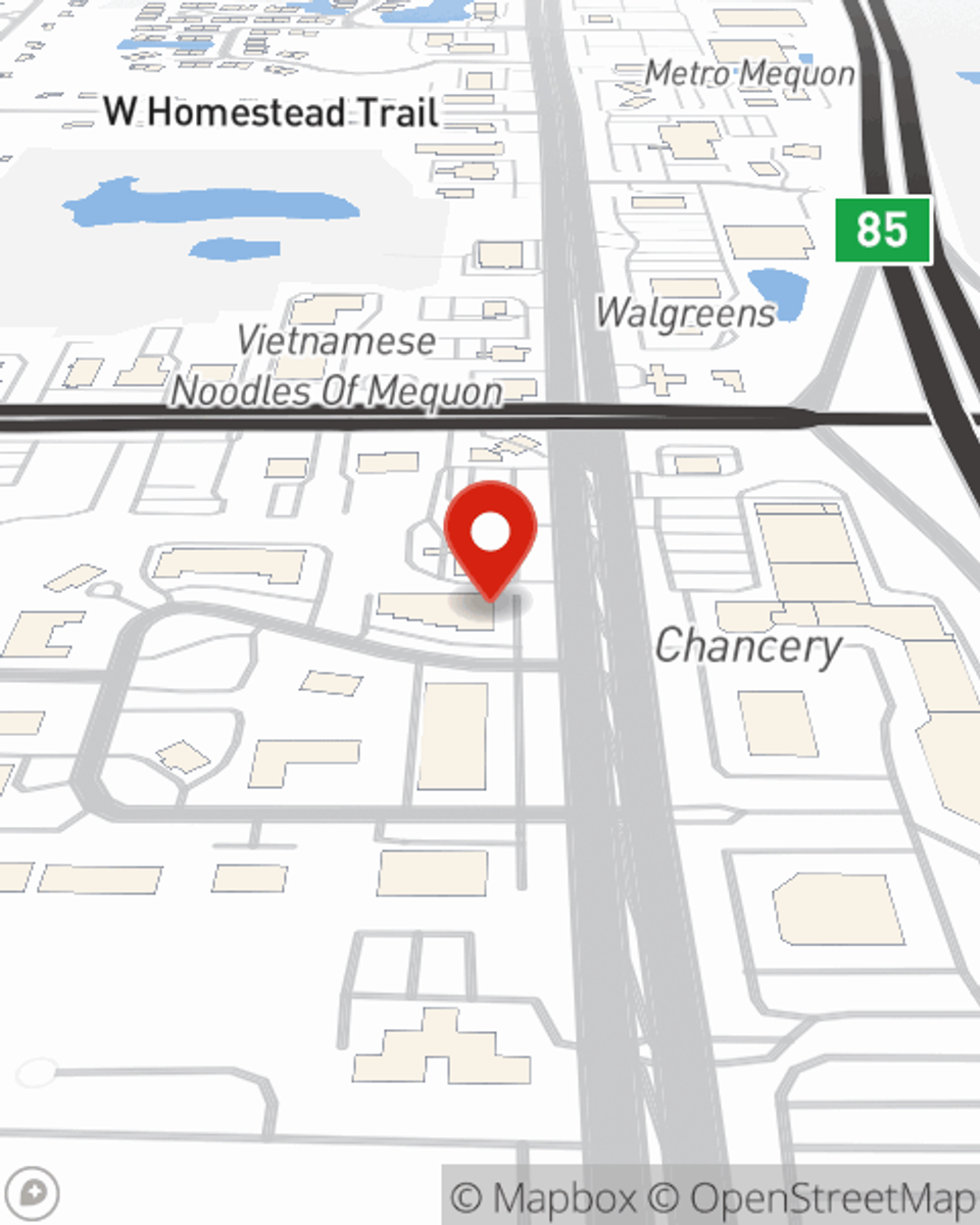

Life Insurance in and around Mequon

Coverage for your loved ones' sake

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

- Mequon

- Thiensville

- Cedarburg

- Milwaukee

- Ozaukee

- West Bend

- North Shore

- MKE

- Janesville

- Brown Deer

- Jackson

- Grafton

- Port Washington

- Waukesha

- Washington

- Sheboygan

Be There For Your Loved Ones

The common cost of funerals in the U.S. is around $8,300, according a recent study by the National Funeral Directors Association. Unfortunately, it may be difficult for your loved ones to manage that expense as they face grief and pain. That's where Life insurance with State Farm comes in. Having the right coverage can help your family pay any outstanding bills and not fall into debt.

Coverage for your loved ones' sake

Life won't wait. Neither should you.

Life Insurance You Can Trust

Some of your options with State Farm include coverage for a specific number of years or level or flexible payments with coverage designed to last a lifetime. But these options aren't the only reason to choose State Farm. Agent Andrew Stark's fantastic customer service is what makes Andrew Stark a great asset in helping you opt for the right policy.

State Farm offers a great option for someone who thought they couldn't qualify for life insurance: Guaranteed Issue Final Expense. This coverage can come in handy by covering final expenses like medical bills or funeral costs, ensuring that your loved ones won't have to bear the burden. For help with all your life insurance needs, contact Andrew Stark, your local State Farm agent and see how you can be there for your loved ones—no matter what.

Have More Questions About Life Insurance?

Call Andrew at (262) 241-5920 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Reasons to buy life insurance

Reasons to buy life insurance

Life insurance is often thought of as a way to protect loved ones by providing for final expenses and estate taxes but you can think beyond that.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Andrew Stark

State Farm® Insurance AgentSimple Insights®

Reasons to buy life insurance

Reasons to buy life insurance

Life insurance is often thought of as a way to protect loved ones by providing for final expenses and estate taxes but you can think beyond that.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.